why did i get a tax levy

This step usually occurs after you file your tax return although if. Why Did I Get A Tax Levy.

Governments provide a variety of services to the people they serve.

. The collections department is the department thats. For example if the IRS issued a levy against your wages they would notify your employee. A professional tax relief specialist can assist you conserve time money and frustration by informing you upfront on what you need to do to resolve your specific Internal Revenue Service.

Will have a negative effect on your credit rating and in most cases. The first is assessing the tax you owe. Before issuing a levy the IRS will go through several key steps.

Working With a Tax Professional Attempting to negotiate on your own with the. The collections department is the department thats going to levy your bank account or file a lien against you for any money that is owed. In addition your citymunicipal agency will issue a notice.

You can appeal a tax levy and try to get it released but. Contact the IRS immediately to resolve your tax liability and request a levy release. A levy is a legal seizure of your property to satisfy a tax debt.

A bank levy can take place for various reasons but you can make the process a bit easier by looking at your tax debts first and foremost. A continuous wage levy. An IRS levy permits the legal seizure of your property to satisfy a tax debt.

The IRS can also release a levy if it determines that the levy is causing. Each taxing agency has an assessment side and a collection side. Tax Exempt Bonds.

To get an updated payoff figure the person who owes the tax liability will need to contact the IRS. Its really important to understand what side of the agency youre on. The most common reason above all.

IRS Tax Levy Process. If an IRS Revenue Officer has called you or stopped by your house. In order to pay for these services the government levies taxes on the citizens and companies who benefit.

A qualified tax attorney can halt the bank levy process and help you obtain a fair and affordable tax settlement. A tax levy is a legal process that the IRS takes in order to seize the money you owe in taxes. It can garnish wages take money in your bank or other financial account seize and sell your vehicle.

A tax levy is when the irs takes property or assets to cover an. In other words the levy is a cap on the amount of property tax dollars a local. If you receive a notice stating that you owe money it is.

This information cannot be released to the employer. It is important that the tax liability is resolved as quickly as possible before filing a lien becomes necessary. A tax levy is when the IRS places a fine on a taxpayers assets or property due to.

Yes the IRS wants to hear from you. A tax levy is when the irs takes property or assets to cover an outstanding tax bill. Prior to the levy the IRS will have issued a notice of intent to levy and notice of your right to a hearing about the levy.

The IRS can garnish wages take money from your bank account seize your property and more if you fail to pay your tax debt. A lien is a legal claim against property to secure payment of the tax debt while a. A levy represents the total amount of funds a local unit of government may collect on a tax rate.

Levies are different from liens. If they have written you a letter they want a response.

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

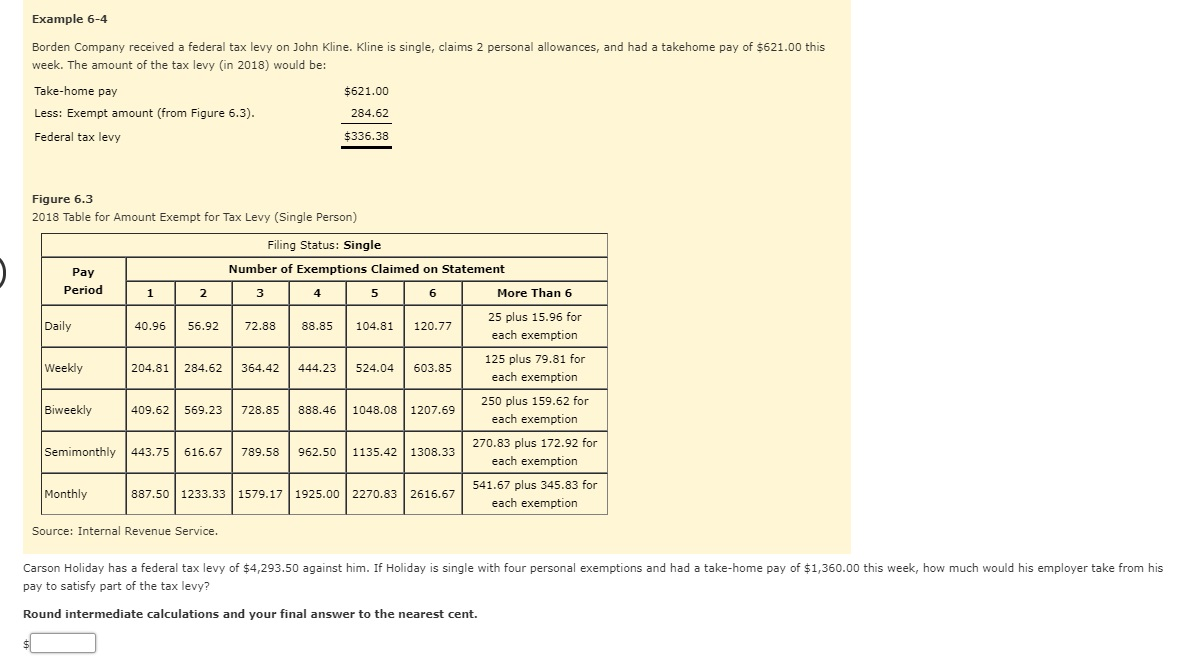

Solved Example 6 4 Borden Company Received A Federal Tax Chegg Com

What Do To If You Receive An Irs Wage Levy

3 Ways To Stop An Irs Tax Levy Nick Nemeth Blog

Irs Tax Levy Vs Irs Tax Lien What Is The Difference Rjs Law

What Is A Tax Levy And How Do You Prevent It Finance Tips Business Accounting Blog

What Is A Tax Levy And Tax Lien Thestreet

Irs Levy On Business Bank Account What To Do When Business Levied

Irs And State Bank Levy Information Larson Tax Relief

Get Irs Tax Levy Relief Tax Levy Attorneys Victory Tax Lawyers

State Bank Levy How To Where To Get Help With Bank Levies

3 Proven Ways To Stop California State Tax Levy On Bank Account

Notice Of Levy Will The Irs Seize My Assets

Irs Levy Tax Matters Solutions Llc

Avoiding Federal Tax Levy What Is A Levy Ohio Tax Lawyer

How To Release An Irs Levy Remove Federal Tax Levy

Irs Bank Levy Release Tax Levy Rush Tax Resolution